Many Fed watchers have long said that the board, with is charged with the “dual mandate” of ensuring stable inflation and employment, does not actually pay equal attention to the two. In fact, a couple of weeks ago, I wrote that it would beyond the pale to say that these rich former bankers and economists, who exclusively mingle with other rich bankers and economists, take the interests of their friends in not seeing their massive fortunes eaten away by inflation more seriously than the interests of most American people who would like to see a strong labor market.

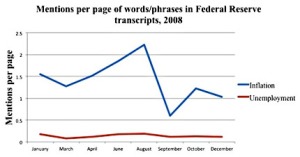

I was kidding of course, that is a huge part of the problem. Ryan Avent at The Economist got tired of analyzing how the Fed’s policies would accomplish their goal, and instead just counted words from the 2008 transcripts of meetings during the Financial Crisis. Avent found that the Fed cares ten times more about inflation than unemployment:

I don’t know how much more there is to say about this, so I’ll let Kevin Drum do it for me:

I don’t think this comes as much of a surprise to anyone, since it’s been obvious for decades that the Fed not only doesn’t care about unemployment, but gets positively worried when too many people have jobs. That would mean the labor market is tight and workers might get paid more, you see, and that could be inflationary.

And we wouldn’t want most Americans to win out over the friends of rich banksters and economists!